While it’s lean times for global carmakers, scrounging for scarce chips and parts, it’s prosperous days for auto dealers. Sitting in the Goldilocks zone between cash-fat post-pandemic consumers and a shortage of vehicles coming from atop, car sellers are living through an ascendant present, getting the most out of car sales.

Profit reports from the first quarter of 2022 indicated dealerships were seeing an upswing in profits. In May 2022, Haig Partners, which advises both buyers and sellers of car dealerships and dealership groups, found that the average gross profit per new vehicle sold was $6,244. In turn, the average publicly owned dealership made $7.1 million in the 12 months leading up to March 2022. Unfortunately, money begets greed, and there have been reports of price-gouging. Consumers who were already dealing with higher fuel prices, elevated interest rates, and declining GDP now had to deal with more expensive vehicles. Fortunately, a solution for those looking to buy new cars emerged.

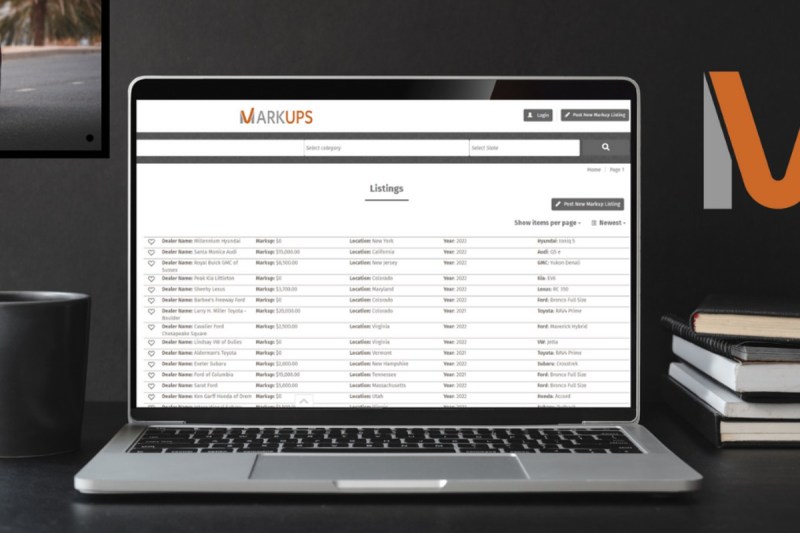

Markups.org lists thousands of specific vehicles, the dealers selling them, and the dealers’ markup in an easy-to-navigate, searchable database. After launching in January 2022, the site’s dealer markup listing has gone viral, with the worst markup offenders on Markups.org getting written up on Car and Driver and Jalopnik this summer. Markups, co-founded by siblings Tiffany Soucie-Howren and Trey Soucie are looking to disrupt an entire industry through crowdsourcing — the foundation for Markups.org and its competitive advantage.

“The problem with the majority of other new car search sites is that they are not using crowdsourced data — they are using the data dealerships provide,” Soucie-Howren said. “We have found that the majority of dealerships do not display the true markup data or mandated add-ons.”

Markups.org began as an individual response to a car seller trying to extort exorbitant profits from a pickup truck. In mid-2021, Soucie traveled across Maine to purchase a Chevrolet Trail Boss pickup only to find the price not at MSRP, but marked up by $10,000. After wasting a day driving across the state, Soucie responded like a true car guy, funneling his angst into a novel solution. For the next few months, Soucie compiled a data set listing 500 to 1,000 self-sourced car prices and confirmed live numbers from forum posts.

Where Trey provided the research, Tiffany provided the know-how. Her background in scaling businesses and elevating them with subscription-based site marketing expertise convinced Trey to take the plunge to form an LLC in November/December 2021 to purchase a hosting site and start building the crowdsourcing software. Since then, the concerted effort has generated considerable national exposure, allowing Markups.org to grow as an industry disruptor.

“It’s a great start, but the United States is a huge territory,” Soucie-Howren said in a conversation with The Manual. “We’d like to be able to help people on a granular level. If you’re searching for a dealership in Houston, Texas, we want to have enough data to look at every single dealership experience, so they know the best fit for them.”

Providing consumers with legitimate data not only fulfills the Soucie siblings’ mission, but these numbers are also sourced from primary research at dealerships.

“Oftentimes, consumers are not even seeing the real, out-the-door prices, with overpriced mandatory add-ons or markups added, until they are sitting in the finance office,” Soucie-Howren stated. “We believe this is the real data shoppers want and deserve to see — the data that’s only brought to light by consumers firsthand, after spending time in the dealership or on the phone (or chat) with a sales rep.”

There was an expected pushback from dealers threatening to sue to recoup profits, but to date, there’s been no formal legal action taken against Markups for posting untrue or proprietary information. These are the prices that are put out to the public and the site only aggregates that data. For the time being, the founders moderate all posts. In the future, there are plans to employ third-party moderators. About 80% of disputes to date have been matched with consumer proof and there is a “report ad” feature to dispute listings.

“That triggers a more in-depth review of a post. We contact the user that made the post and begin the process of collecting proof and asking about the interaction with the dealership,” Soucie-Howren said.

This will be a more strenuous process in the near future for the website. One of its future product features will be a verification badge identifying the lister as a dealer, a verified user, or an unverified user. Incorporating all commercial parties is an important vision for Markups.

“We created it to become a tool of value for not only the consumers, but the dealerships, the OEMs, and data analysts,” Soucie-Howren said. “Dealerships can use our tool for competitive analysis. OEMs can use it to track their brand reputation and get use cases from [it]. It enables data analysis and economists to have transparency into what is really going on in this part of the automotive industry.”

Looking at the cars listed on Markups.org right now, Soucie-Howren sees an odd consistent dichotomy — the same car brands and similar locations overlap between the worst offenders and most honest dealers. She estimates that Kia and Hyundai are both averaging around a $7,500 markup. Approximately 10-to-15% of Kia and Hyundai dealers, however, are not charging any markups.

California and Texas share the highest number of non-markup dealers on Markups and some of the worst offenders (though this is likely tied to high urban populations). Luxury car buyers also need to beware, as the listings for Cadillac, Mercedes, and Lexus consistently average higher markups, probably thinking that high-end consumers are willing to pay a premium.

As the market continues to boom, data suggests that deals are worth the research. A $1,000, $2,000, or $12,000 dealer markup is a major blow to dodge. While some supply chain problems continue to exist, J.P. Morgan Research said the microchip shortage that had plagued the industry since the COVID-19 pandemic, is easing.

While the outlook for production seems to be improving, auto dealers are expected to continue to inflate new car prices. And the data suggests there are no brands not guilty of taking advantage.

“Toyota seems to be about 50/50 markup to non-markup right now,” Soucie-Howren added. “We would say (it’s) in the lead for non-markups, but even 50% isn’t a great number.”

How to avoid (or at least reduce) markups

There are ways to avoid dealer markups, or at least knock the price down to something more affordable.

Many dealers add accessories to new cars to bump up the price, sometimes by thousands of dollars. According to a report in U.S. News and World Report, Edmunds, an online guide for car buyers, the markup on these accessories is generally 40% to 50% higher than the retail price. Some of the add-ons, such as wheel locks and nitrogen-filled tires, could possibly be removed from the car, but most dealers are reluctant to remove them, though they may be willing to reduce the price. And some add-ons, such as specially treated paint, can’t be removed.

One of the easiest ways to get around a dealer markup is to order a car directly from the manufacturer. While ordering direct will result in a longer wait time for the car, most cars ordered direct from the factory will be sold without any markup.

Another way to get the best price for a new car is to shop around, As Markups.org shows, markups can vary by individual dealer, so doing a search of dealers within a reasonable distance could lead to finding dealerships with a lower markup or even no markup on the same car. Once again, this process can take longer than just going into a local dealership, but a little bit of work and patience can save you thousands.

Correction: An earlier version of this story incorrectly identified Markups.org as a nonprofit. We apologize for the error.