They say money makes the world go round, but trying to manage your finances can also be incredibly stressful. Even when you’re not struggling to make ends meet, keeping track of where your hard-earned cash goes, how much you’re saving, and what you can realistically dedicate to your fun fund can be the source of many a migraine.

Luckily, the days of having to hand-balance your checkbook and learn expert-level Excel functionality just to draft a smart budget are over. With the rise of smartphones and tablets came the rise of convenience apps, and there are tons of great options out there to help you manage your money. We’ve rounded up some of our favorites here to help you get a handle on your bankroll and make sure you’re spending wisely. These finance apps include budgeting, money-saving, investments, expenses, and more.

For a Well-Rounded View of Your Finances:

Mint

Free; Available for iOS and Android

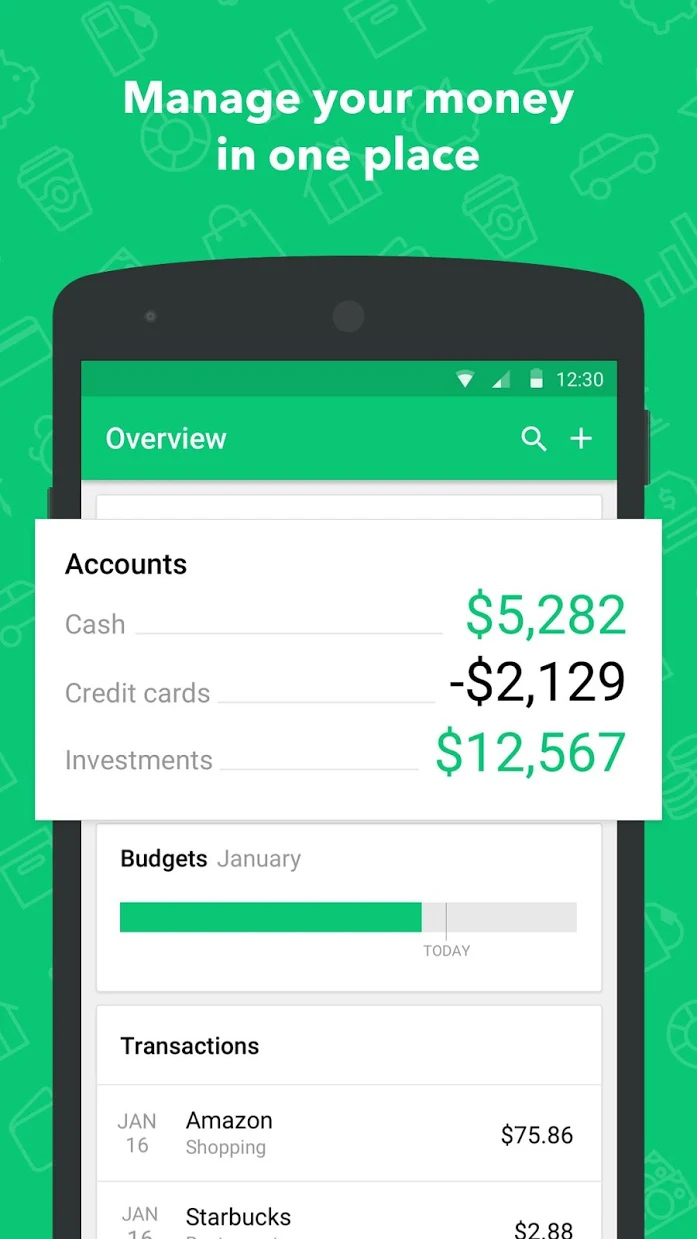

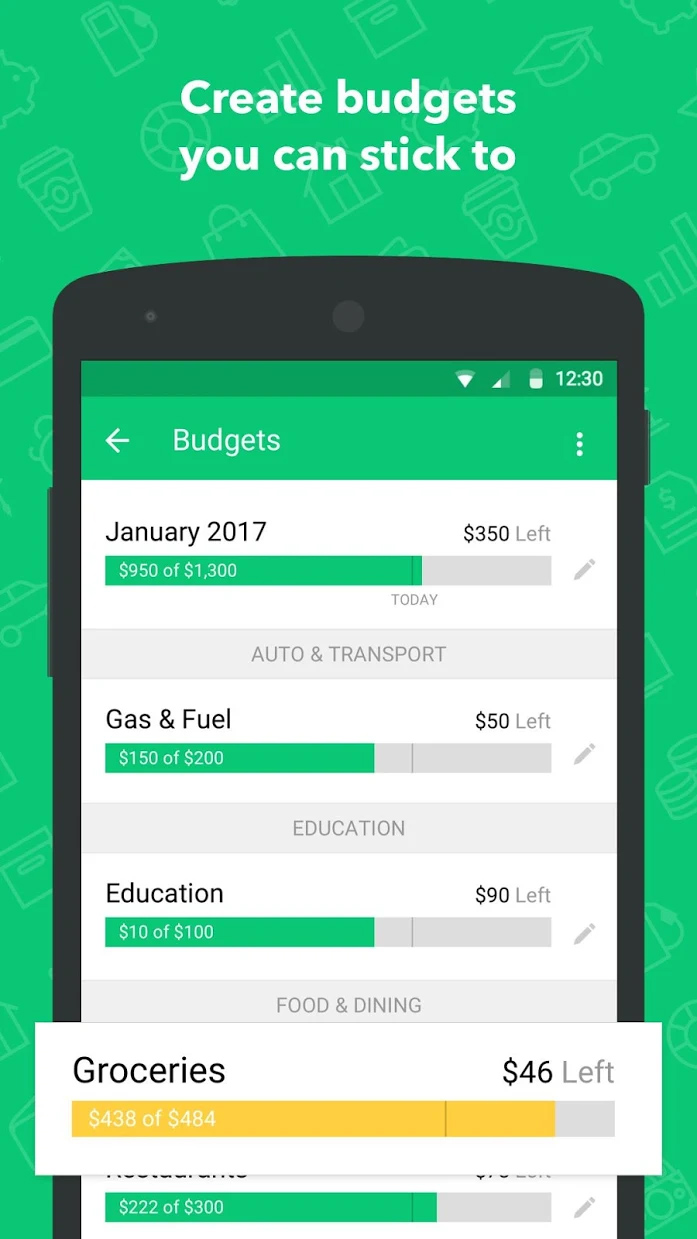

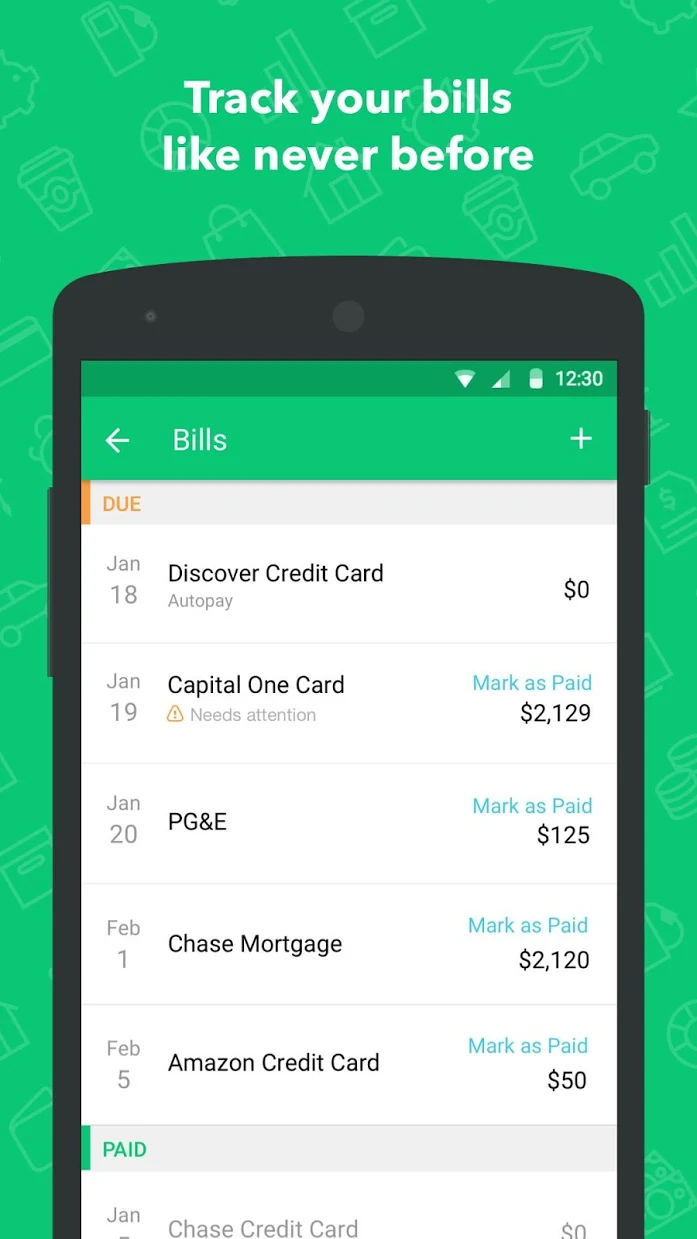

Mint is the reigning king of finance apps. Created by Intuit (of QuickBooks and TurboTax financial fame), it’s the most well-rounded app you’ll find to help manage money. Mint connects to nearly every U.S. financial institution, so you can connect all your accounts — including checking, savings, credit cards, and retirement and investment accounts — and monitor your financial health from a broad perspective. You can also connect and manage your bills through the app, and it will send you notifications and reminders to let you know when they’re due and how much you owe. You can track your investments, create a budget, compare your wealth to your debt, view how much you’ll save if you cut back spending in a certain area, and see a projection of how much money you can expect to have at the end of the month or year based on current expenses. While the app does a lot automatically (like updating balances in real-time and creating suggested budgets), there’s plenty of room for customization if you want to change how expenses are categorized or alter your suggested budget. On top of it all, you have access to a free credit score, and the app will alert you of charged fees, low accounts, and unusual spending.

For a Snapshot of Your Pocket Money:

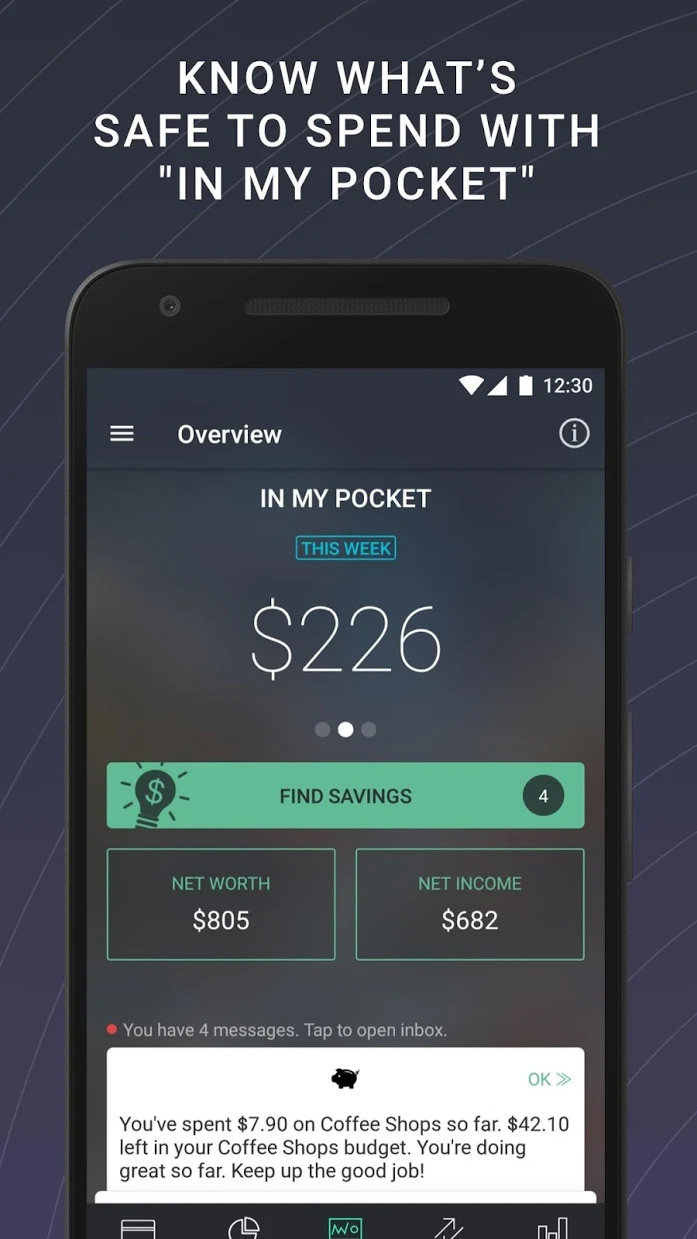

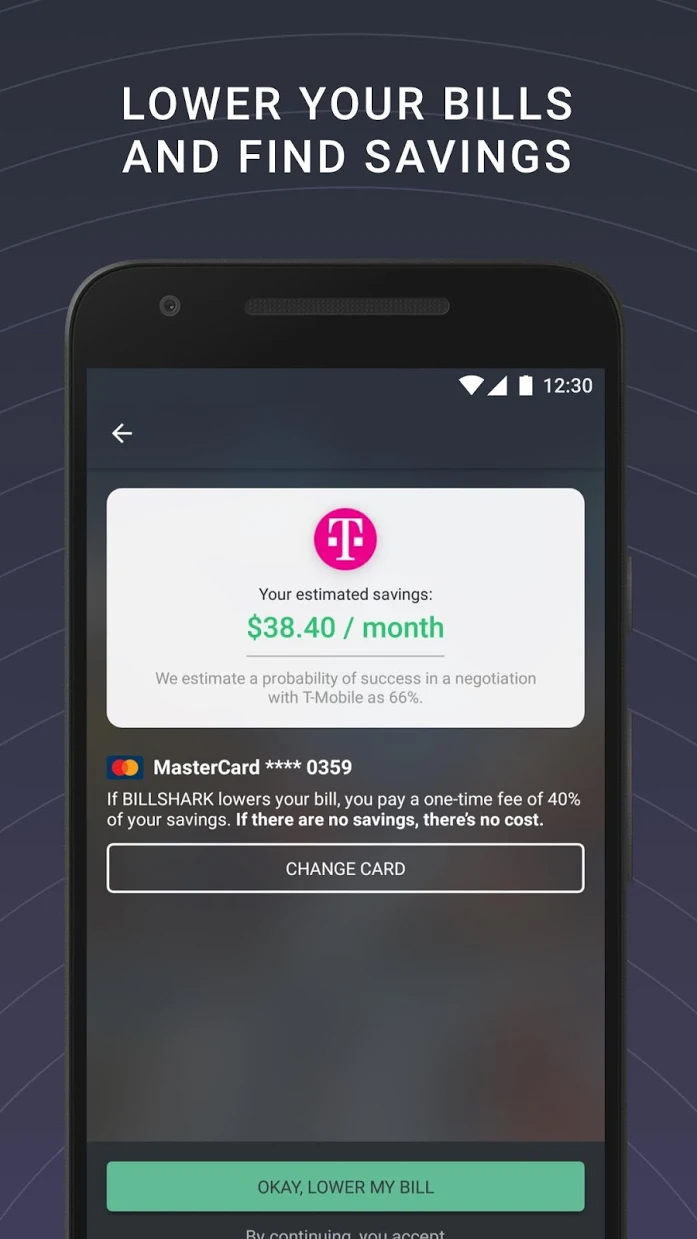

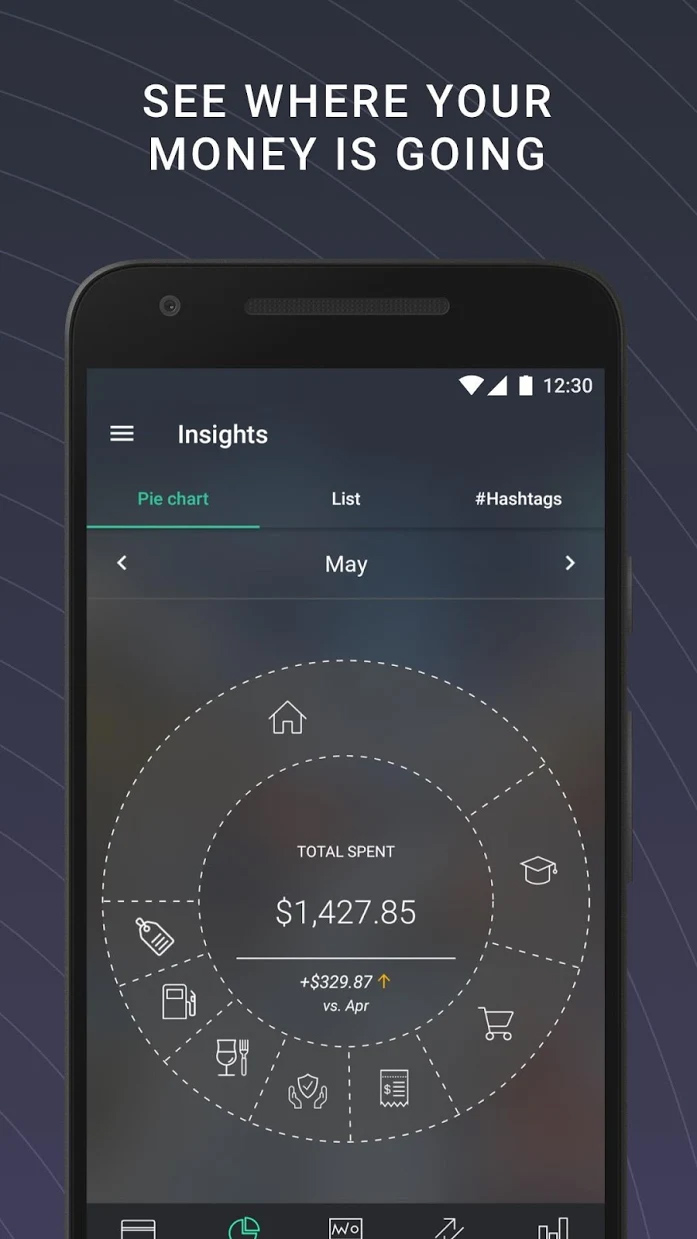

PocketGuard

Free, In-App Purchases; Available for iOS and Android

PocketGuard is an app built for people who want something simple and unobtrusive that will keep them honest about how much money they can realistically spend freely. Connect all of your accounts and the app will show you what your money goes to every month and ways you can save by improving your spending in certain areas. It will also build a personalized budget for you to help you meet financial goals. While the app has several helpful and simple-to-use features, its biggest appeal is definitely the “in my pocket” feature, which will show you exactly how much money is safe for you to spend each day, week, or month after you’ve paid your bills and contributed to savings. Even if you decide not to dive deep into the other parts of the app, knowing how much is in your “pocket” every week is a godsend for anyone and everyone who wants better financial health without having to obsess over every expense.

For Money-Saving:

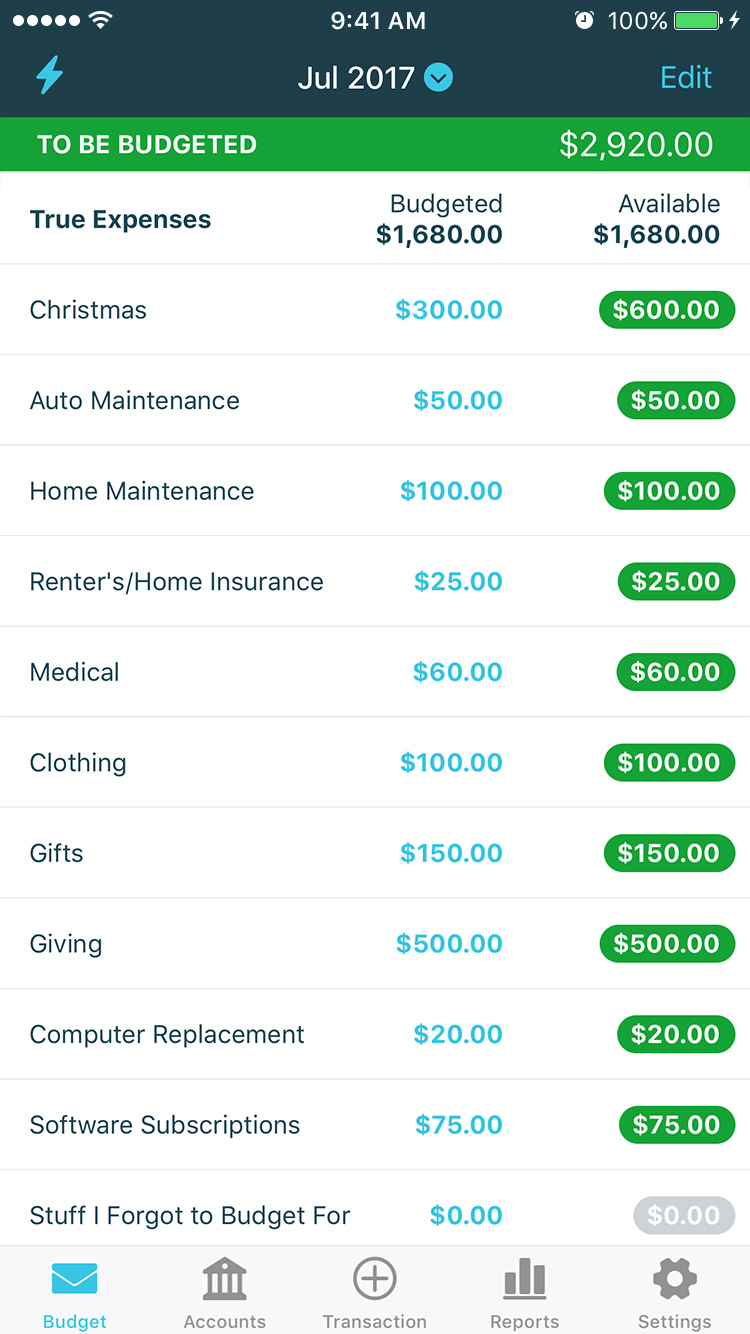

You Need a Budget

Free, In-App Purchases; Available for iOS and Android

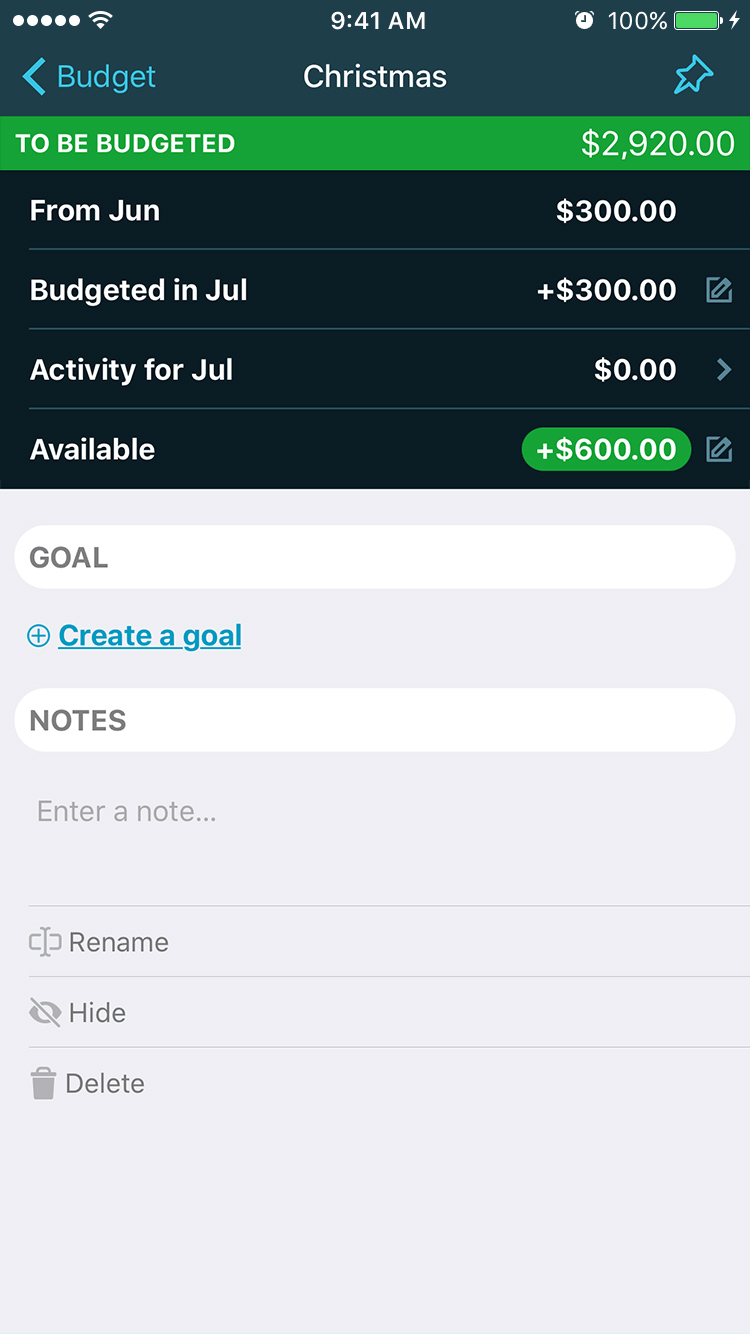

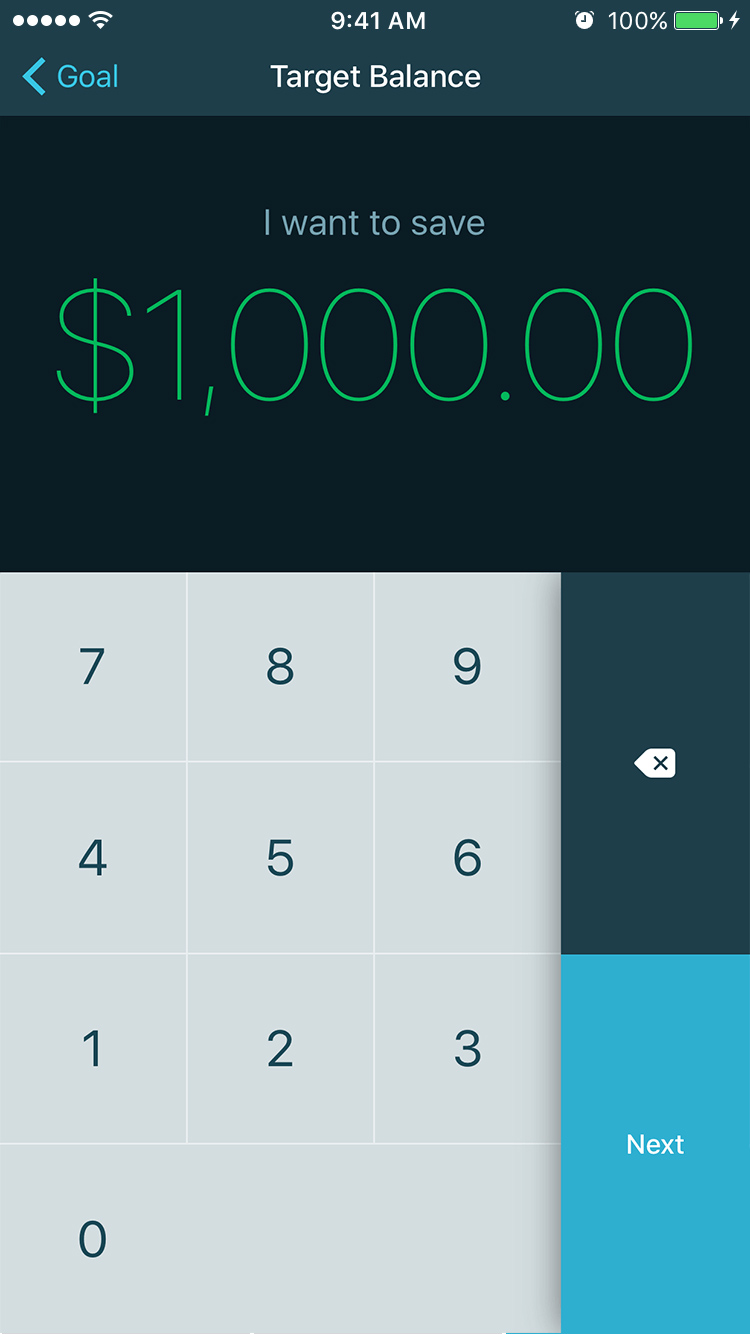

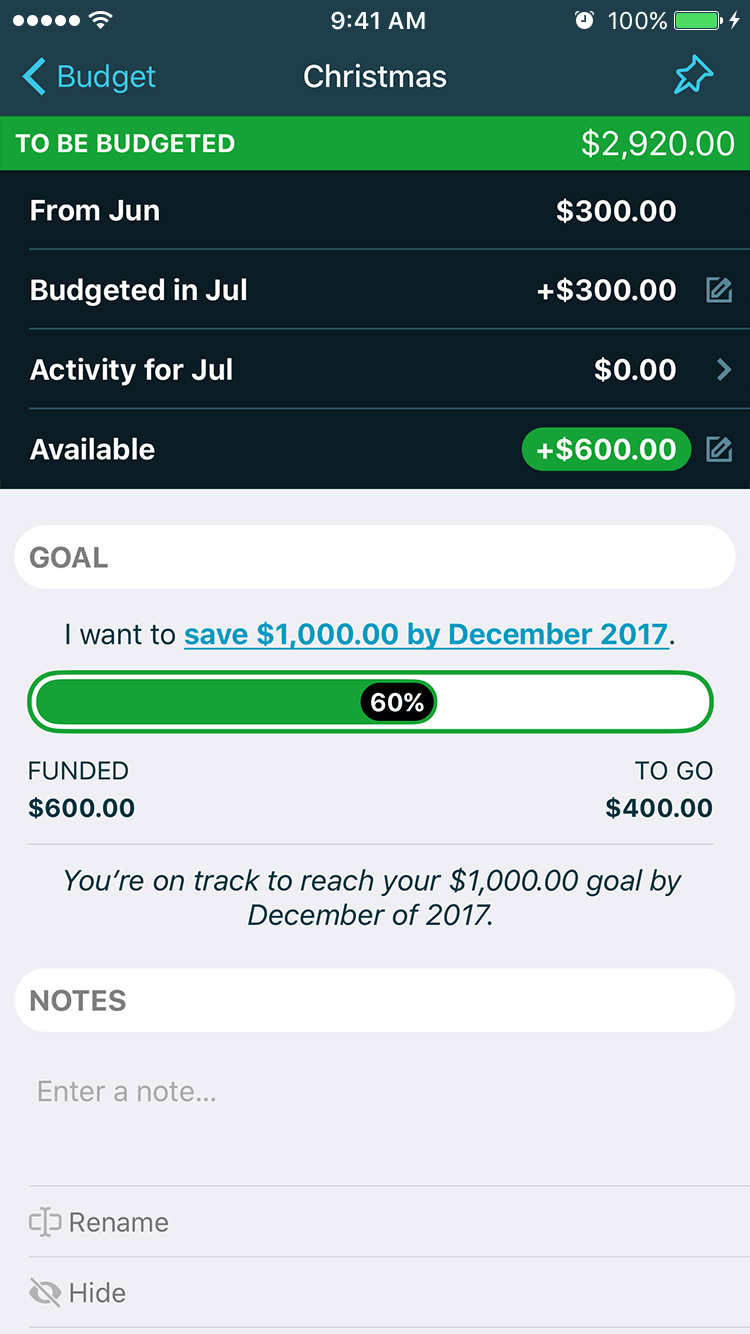

You Need a Budget’s goal is to help you get out of debt and become better prepared for unexpected expenses. It’s built around one guiding principle: “Give every dollar a job.” Once you connect your accounts, YNAB walks you through separating all of your spending into categories and then instructs you on the best ways to move money from one category to another to keep everything balanced and avoid overspending. Every step of the way, the app encourages you to think broadly and realistically about your finances by labeling every predictable expense you’ll encounter and showing you how you should be allocating your income to cover it. If you overspend one month, it will suggest categories you can cut back in to cover the extra cost. The app is simple and encouraging to use, and over time it helps you shift away from paycheck-to-paycheck living by teaching you how to account for every penny without constantly feeling stressed about the next big expense.

For Beginner Investments:

Acorns

$1-3/month; Available for iOS and Android

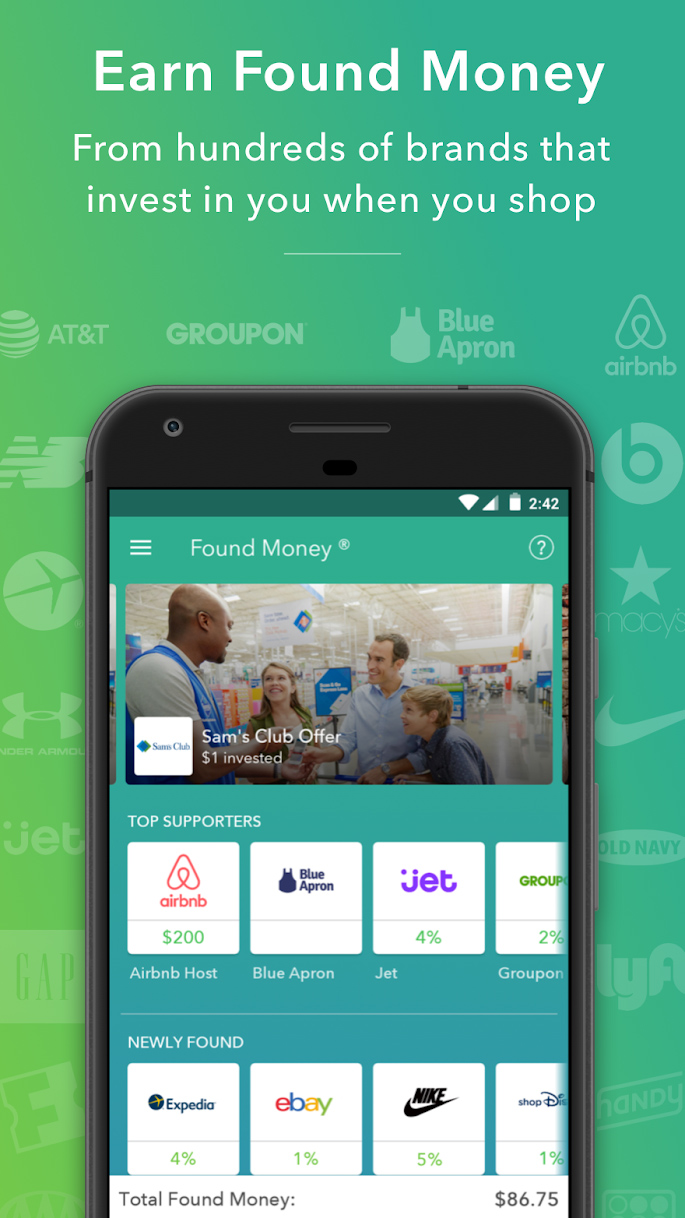

Acorns is built for the casual investor. If you’d like to dedicate some extra cash to investments but don’t think you have enough or aren’t sure where to start, check out Acorns. Connect cards to the app and every time you use them for a purchase, it rounds up to the next dollar and puts the spare change into exchange-traded funds. No giant bankroll or Wall Street savvy needed. You can also choose to set up daily, weekly, or monthly recurring investments, or make one-time investments at your discretion. You decide your own risk preference for investment, so you don’t have to feel like you’re playing high stakes poker with your precious pennies.

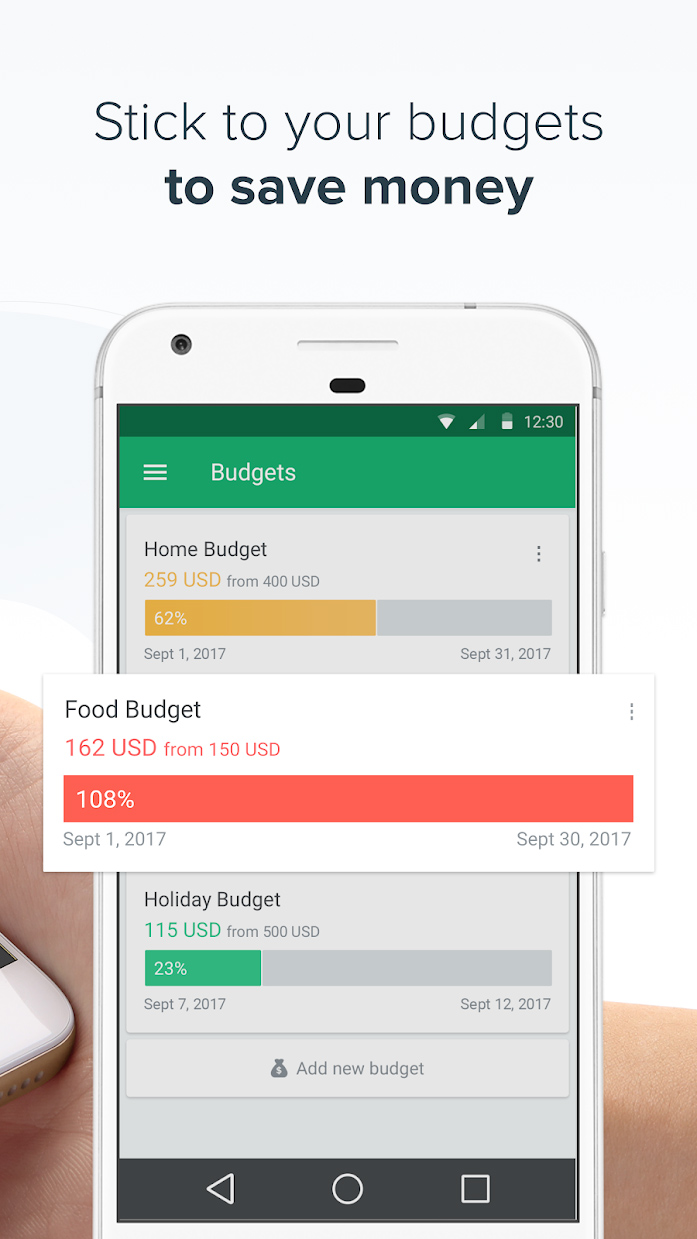

For Shared Budgeting:

Spendee

Free, In-App Purchases; Available for iOS and Android

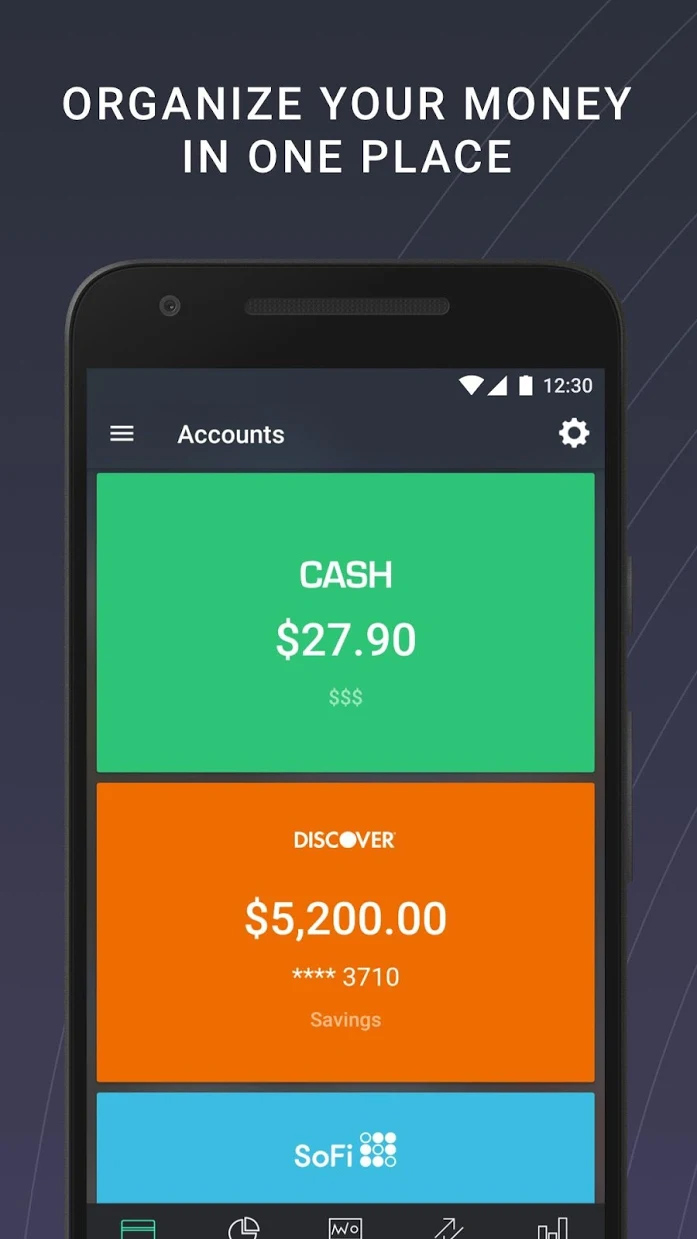

Spendee is a robust financial tracking and planning app whose shared wallets option makes it ideal for couples, families, and roommates looking to track their finances together. Shared wallets import information from each user’s connected accounts and provide you with an overall view of how to meet your financial goals and save money together. You can connect bank accounts as well as crypto- and E-wallets and input cash expenses manually to get a full view of how your money flows (and where to) each month. Spendee will let you know whether you’re on track to spend less than you earn, and you can set budgets to help control spending in one or more categories and see how much you’re able to spend per day without breaking your budget. If your household is saving up for a big expense, like a vacation or tuition costs, you can set special event budgets to help you reach your shared goals. All of your financial summary information is presented in intuitive, easy-to-read graphics and charts that help you visualize exactly where you and your money stand. The app also supports multiple currencies and gives you the option of adding pictures and locations to each expense.

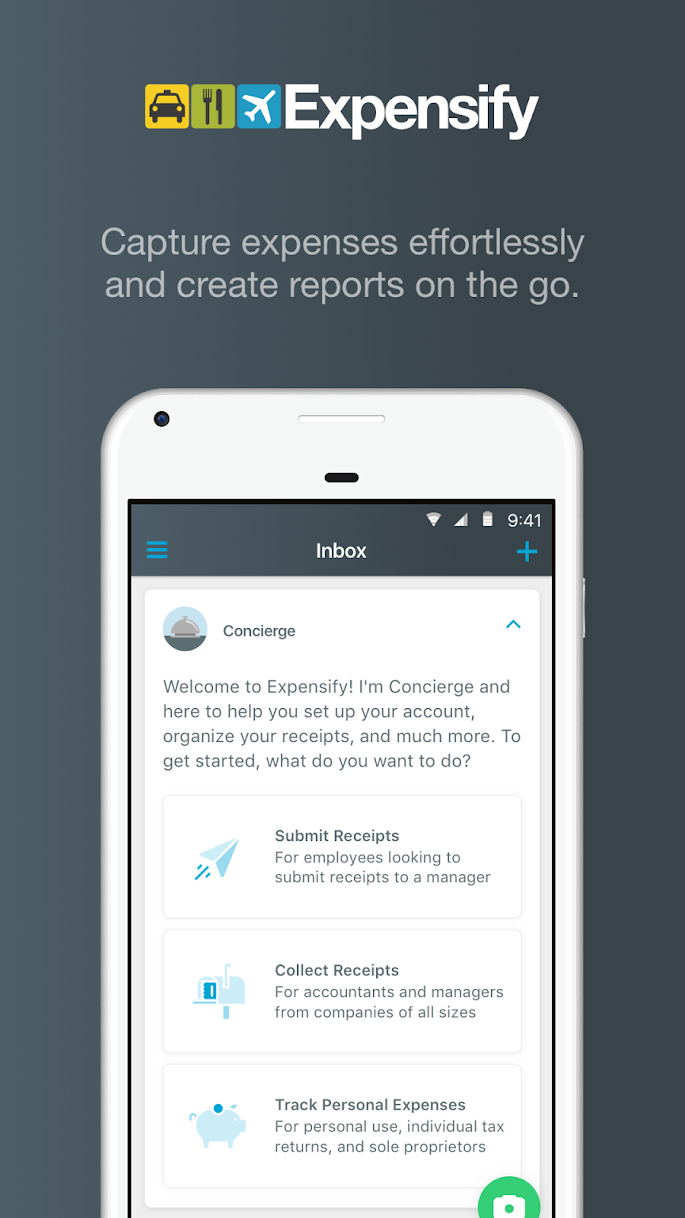

For Business Expenses:

Expensify

Free, Optional Subscriptions; Available for iOS and Android

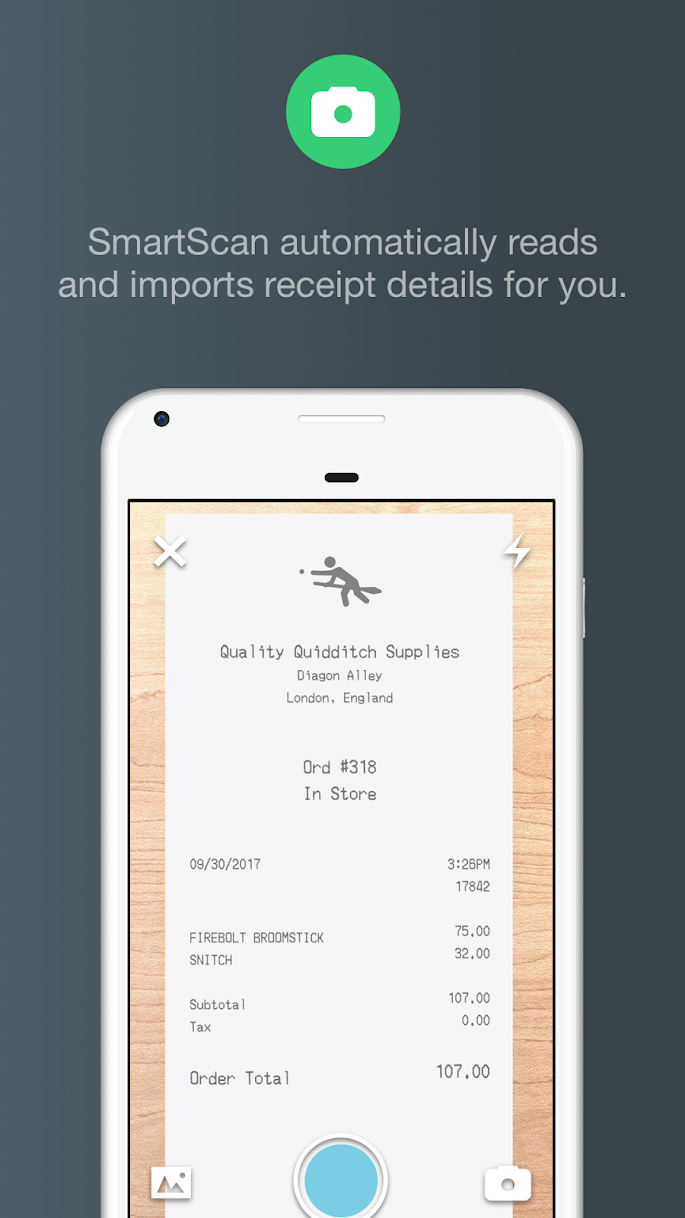

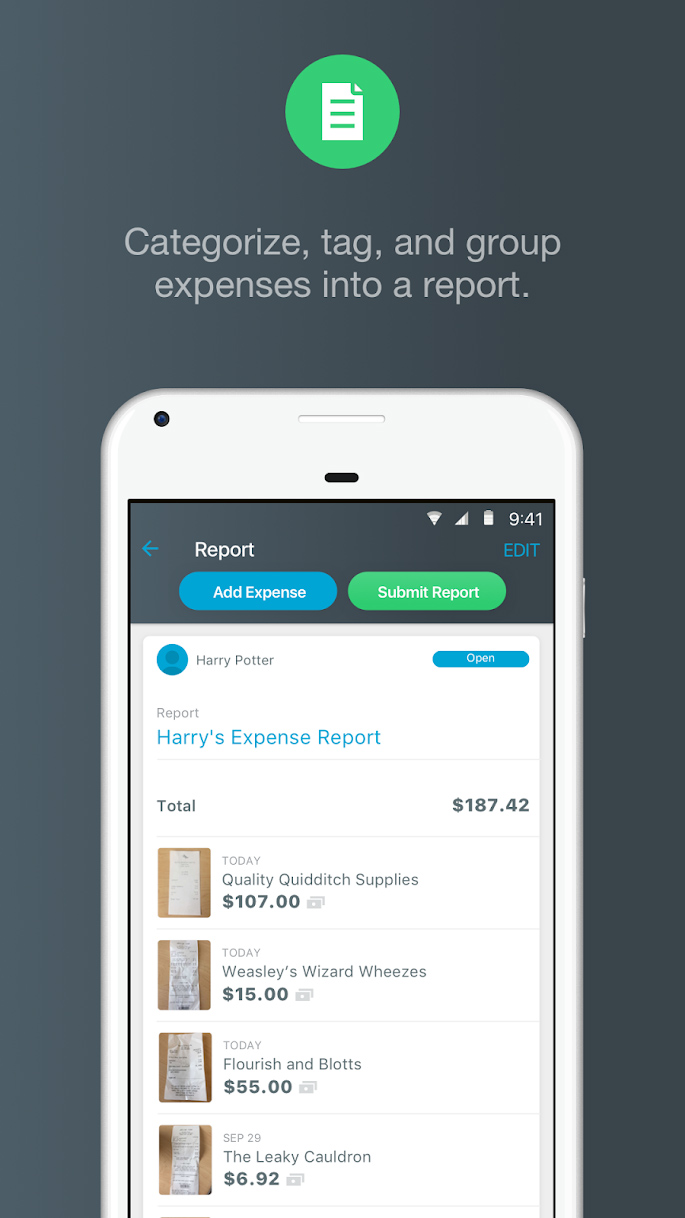

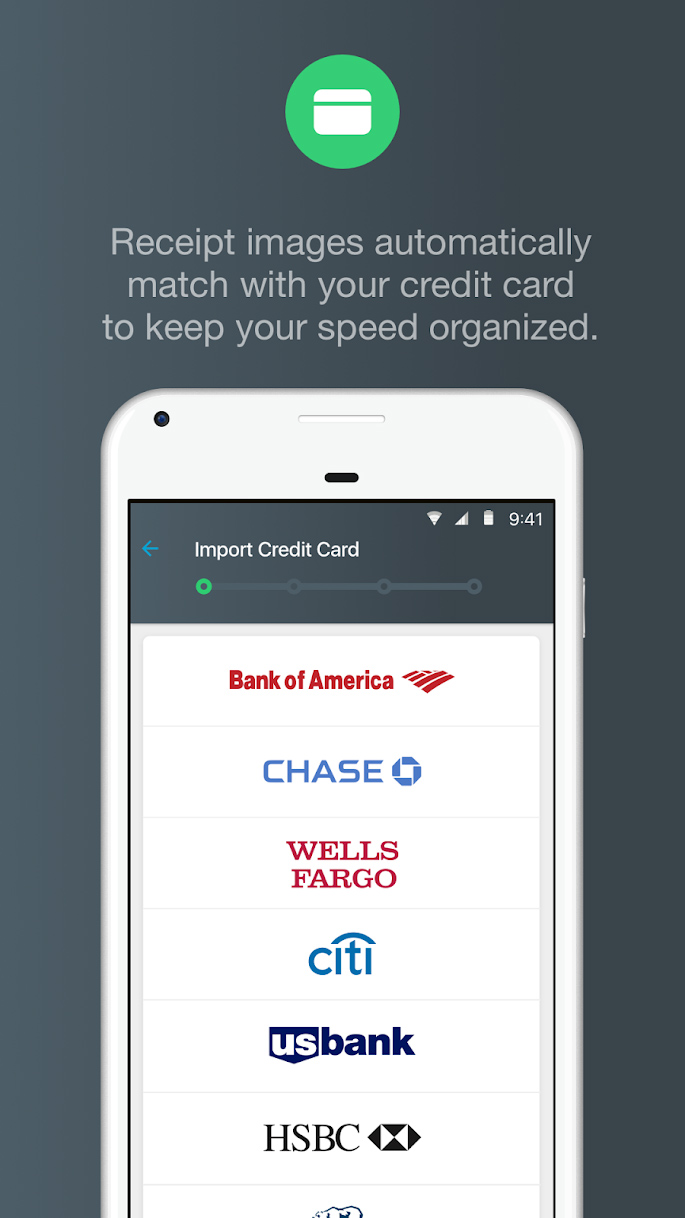

Expensify is a great app if you do a lot of business-related traveling and yearn for a better way to track spending for expense reports. You can import a card account and the app will help you track, manage, edit, and report your expenses without all the headache of manual reports. You can track mileage as well as time and rate expenses, and the SmartScan feature will automatically pull data from photos of your receipts (the free version has a 5 SmartScans-per-month limit, but if you need more you can opt into a subscription that makes them unlimited). Even without SmartScan, you can manually photograph and save an unlimited number of receipts in the app. Expensify can also automatically import digital receipts from a number of companies, including Uber, Lyft, HotelTonight, Airbnb, and more. You can create personalized rules so expenses from a specific merchant will automatically be added to designated categories and reports. When you’re ready to submit an expense report, you can export data to Excel or PDF format, or you can use the app’s Scheduled Submit feature to automatically open and populate recurring reports to have them ready for you on the day they’re due. The app also features automatic currency conversion, so you can use it even if you’re traveling abroad.

For Freelance Financial Health:

Tycoon

Free, In-App Purchases; Available for iOS and Android

Tycoon tackles one of the most frustrating financial woes: keeping track of your jobs and income from freelance work. As soon as you get a new gig, add the details into your job list and the app will keep track of payment for everything you’ve got in the works. Tycoon separates your jobs into three categories: overdue, waiting, and paid so you can get a quick overview of your finances. It will notify you if a payment from a client is overdue, and you can send them a reminder email with all the details from within the app. With the help of Tycoon, you can stay up to date on how much you’ve made and how much you’re owed, see how much you should save for taxes from each job, record gigs in any currency, calculate take-home pay minus agent commission, and export income data to your accountant. If you want to populate the app with historical data, you even have the option of sending your past job tracking information to the Tycoon team and they’ll add it to your account to save you the trouble of entering it manually.

Article originally published August 21, 2018.